The average person lives a life that is full of and dependent on transactions. In 2016, the number of debit transactions per active card in the U.S. reached 23.6 per month. That number doesn’t even include transactions with cash, credit card, or checks! Making some sort of purchase everyday is practically the norm for today’s consumer in a world of convenience. Most of these purchases are between an individual and a business, but there are many instances where friends and family make informal payments to each other. Have you ever eaten out in a big group of people and been frustrated by the process of trying to split the bill? The waiter won’t split the checks, and not everyone has cash. In other words, it’s a nightmare. Or, have you had a friend buy your ticket while you sit in the movie theater hoping you’ll remember to pay them back? There has been no standard process for sending payments to other individuals, but in today’s digital world, digital payments offer convenient ways to do so.

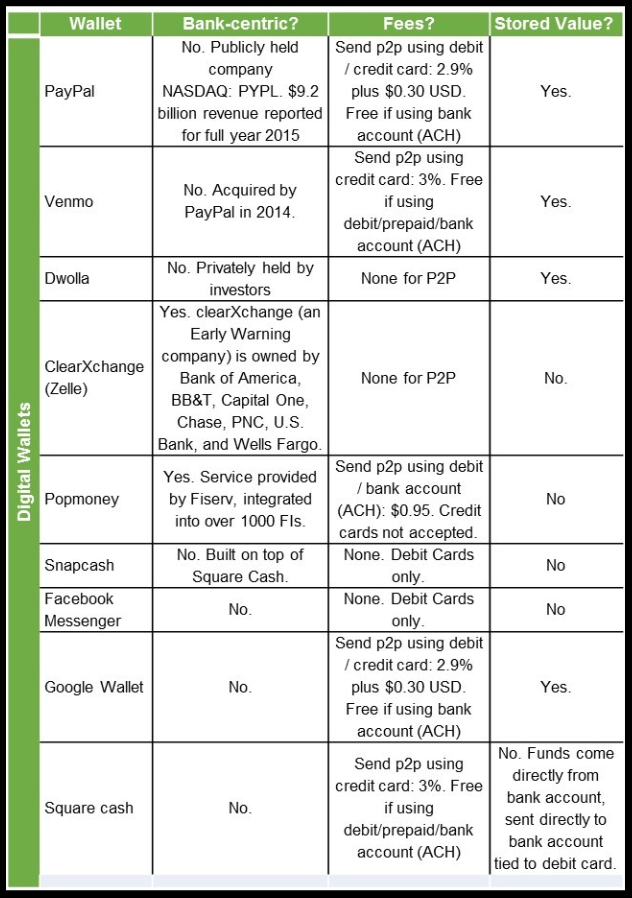

Many apps exist that are dedicated solely to the job of helping you make and receive payments from friends. Venmo is one of the top platforms, with a slick interface and high user count. Other options include Paypal, Dwolla, ClearXchange, and Popmoney. Apps like these remove the headache of eating out in groups and spare friendships from passive aggressive anger regarding unpaid debt.

Source: http://www.thepaymentsreview.com/a-look-at-p2p-payments

Social networks, already experienced in handling money through advertising sales, have created their own P2P (person to person) payments. Now sending money is as easy as texting. Facebook is especially convenient, considering “you’ve already got your network of friends and family on there.” In Snapchat, a platform that is very popular with kids and teens for sharing images and texts that disappear after a short time, the Snapcash feature provides users with a quick way to send each other money from debit cards. These conveniences eliminate the question “Do I really need a separate app for that?” But just because these methods are fast and easy, does that mean you should do it? It depends.

Since a lot of apps with P2P store your money within the app itself rather than in a bank, this can be cause for concern. A bank account has federal deposit insurance, meaning that if the institution fails, you still get your money back. Not all P2P apps have this protection. ClearXchange and Popmoney are the only bank-centric institutions that provide P2P payment services (see table above).

Another factor to consider is that kids and teens, many of whom have access to debit cards nowadays, use social networking apps to a huge extent. Social media P2P payments offer no help to parents who want to supervise their children’s purchases. Especially on Snapchat, where the feature of disappearing content encourages a large number of nude photo exchanges, Snapcash creates an eerily conducive environment for people to pay each other for this type of content. For underage children who don’t know who is behind the username they’re talking to, this could be dangerous.

Using social media for P2P payments is incredibly convenient for those personal transactions we make among friends and family, but it also carries some safety concerns. Be wary of storing dollar balances in social media apps, and talk to your kids about what’s considered appropriate for social media P2P payments in your household. Not sure how you feel about social media P2P payments just yet? Be sure to use Go2s to discuss and share with your extended family or other parents in your neighborhood about their feelings. Get informed, have meaningful conversations, and make the choice that’s right for you.

Go2s is a trusted social network that has been built on three basic core values: kindness, respect, and trust. The Go2s vision incorporates the idea of P2P payments with the mission of promoting the common good. Users can earn Go2sPoints while they help create a safe and supportive online network. Then, users can redeem those Go2sPoints for actual dollar amounts to be contributed to fundraising efforts and charitable causes. The benefits of social networking on the Go2s platform are not limited to online interactions. This is the Go2s vision – to empower users to create a positive impact on their community as a whole.